THIS PRESS RELEASE IS RESTRICTED AND IS NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, WHETHER DIRECTLY OR INDIRECTLY AND WHETHER IN WHOLE OR IN PART, INTO OR IN THE UNITED STATES OF AMERICA, AUSTRALIA, JAPAN OR IN ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION.

ADVERTISEMENT. This announcement is an advertisement relating to the intention of Ebusco Holding N.V. (the “Company” or together with its subsidiaries the „Group“) to proceed with the Rights Issue and the admission to listing and trading of the Rights and the Offer Shares (each as defined below) (the “Admission”). This announcement does not constitute a prospectus. This announcement is for information purposes only and does not constitute, or form part of, an offer by, or invitation by or on behalf of, the Company or any representative of the Company to purchase any securities, or an offer to sell or issue, or the solicitation to buy, securities by any person in any jurisdiction where doing so would constitute a violation of the applicable laws or regulations of such jurisdiction. Further details about the Rights Issue are included in the prospectus for the purposes of the Admission and the prospectus is approved as such under the respective regulation by the Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële Markten, the “AFM”) on 8 November 2024 and available as of today (the “Prospectus”). The Prospectus has been published and made available at no cost through the website of the Company (https://investors.ebusco.com/rights-issue/), subject to securities law restrictions in certain jurisdictions. Potential investors should read the Prospectus before making an investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in the Rights or the Offer Shares. The approval of the Prospectus by the AFM should not be understood as an endorsement of the quality of the Rights or the Offer Shares.

Ebusco announces the launch of its EUR 36 million Rights Issue

- 3 for 1 Rights Issue of 43,853,031 ordinary shares at an Issue Price of EUR 0.8209 per Offer Share

- Indications of interest from long-term shareholders:

- Peter Bijvelds Holding Erp B.V. for EUR 5.0 million, of which EUR 3.5 million through a conversion of the shareholder loan, provided in August 2024, in equity at the Issue Price

- ING Corporate Investments Mezzanine Fonds B.V. (“ING CI”) and VDVI B.V. (“VDVI”) through converting their shareholder loans of EUR 1.0 million and EUR 0.5 million, respectively, in equity at the Issue Price

- EUR 6.0 million commitment from CVI Investments, Inc. (“CVI”), an entity managed by Heights Capital Management, to subscribe for Rump Shares at the Issue Price

- CVI has also agreed to a restructuring of the repayment terms of the EUR 36.8 million convertible bond, which includes (i) an equitization of the December 2024 and March 2025 instalments to the time of settlement of the Rights Issue, in the form of 7.0 million new shares, (ii) a deferral of the June 2025, September 2025 and December 2025 instalments to the time of the original maturity date in December 2026, adjusting the conversion price to 110% of the theoretical ex-rights price of the Rights Issue

- The Company has further received an indication of interest from Gotion GMBH (“Gotion”) to subscribe for Rump Shares at the Issue Price

- The commitment from CVI represents c. 17% of the Rights Issue. The commitment from CVI together with the indications of interest from the long-term shareholders represents c. 35% of the Rights Issue

- The Issue Price represents a discount of 48.0% to the theoretical ex-rights price of the Rights Issue based on the closing price of EUR 3.85 on Euronext Amsterdam on 7 November 2024

- Ex-rights Date: 11 November 2024

- Rights trading period: from 9:00 CET on 11 November 2024 to 17:34 CET on 18 November 2024

- Record Time: 17:40 CET on 12 November 2024

- Exercise Period: from 9:00 CET on 11 November 2024 to 17:40 CET on 19 November 2024

- In the event the Company is not able to raise EUR 36 million in gross proceeds from the Rights Issue, the Rights Issue will be withdrawn. The Rights will then expire worthless, and any Rights exercise will be ignored.

Deurne, 8 November 2024 – Ebusco (Euronext: EBUS) today announces the launch of a capital increase by means of a Rights Issue, for an amount of EUR 36 million.

Christian Schreyer, CEO of Ebusco, comments: “We are proud that we have now reached the milestone of the rights issue launch after receiving shareholder support in our EGM last month. We are also thankful that we have been able to receive various indications of interest to participate in the rights issue from a number of our existing shareholders, in combination with the support from Heights and Gotion’s intention to become a shareholder in our company. I am now CEO of Ebusco for more than two months and my conviction on the quality of Ebusco’s products, our people and the strength of the underlying market fundamentals has only grown over time. As previously communicated, Ebusco is going through a very difficult phase. A successful completion of the rights issue is therefore crucial for Ebusco to successfully implement the Turnaround Plan, restore the trust in Ebusco as a company for all our stakeholders, and, ultimately, for Ebusco to continue as a going concern”.

Key terms of the Rights Issue

- 3 for 1 Rights Issue of 43,853,031 new ordinary shares (the “Offer Shares”) at the issue price of EUR 0.8209 per Offer Share (the “Issue Price”) (the “Rights Issue”), for an amount of EUR 36 million gross proceeds.

- The Issue Price represents a discount of 48.0% to the theoretical ex-rights price (”TERP”), based on the closing price of EUR 3.85 on Euronext Amsterdam on 7 November 2024.

- Shareholders are being granted transferable subscription entitlements (the “Rights”) in the Rights Issue, which will entitle to subscribe in cash, on an irreducible basis, for Offer Shares.

- In addition, holders of Rights will be entitled to subscribe, on a reducible basis, for an additional number of Offer Shares, at the Issue Price (the “Excess Application”).

- The Offer Shares that were issuable upon the exercise of Rights but that have not been subscribed for during the Exercise Period (the “Rump Shares”) will be offered for sale at the Issue Price through (i) a public offering in the Netherlands (the “Public Offering”) and (ii) private placements to certain institutional investors in certain other eligible jurisdictions.

- After expiry of the Exercise Period unexercised Rights will lapse without value. Shareholders who do not wish to exercise their Rights should therefore sell the Rights during trading.

- Peter Bijvelds Holding Erp B.V. has provided an indication of interest to participate in the Rights Issue for EUR 5.0 million, of which EUR 3.5 million through a conversion of the shareholder loan provided in August 2024 in equity at the Issue Price

- ING Corporate Investments Mezzanine Fonds B.V. (“ING CI”) and VDVI B.V. (“VDVI”) have provided indications of interest to participate in the Rights Issue through converting their shareholder loans of EUR 1.0 million and EUR 0.5 million, respectively, in equity at the Issue Price.

- CVI has irrevocably undertaken to subscribe for Rump Shares which are not taken up for an aggregate amount of EUR 6.0 million.

- The commitment from CVI represents c. 17% of the Rights Issue. The commitment from CVI together with the indications of interest from the long-term shareholders represents c. 35% of the Rights Issue.

- The Company has further received an indication of interest from Gotion to subscribe for Rump Shares at the Issue Price. Any proceeds received from Rump Shares subscribed to by Gotion shall be used by the Company to pay down the accounts payable position it has with Hefei Gotion High-Tech Co. LTD (“Hefei Gotion”). If there are insufficient Rump Shares available in the Rights Issue (as a result of high take-up in the Rights Issue) then the Company and Gotion will further explore the possibility of a separate share issuance to Gotion (for which the proceeds will also be used to pay down the accounts payable position with Hefei Gotion) to strengthen its balance sheet, for which the Company would need to request approval from the General Meeting of Shareholders.

- In the event the Company is not able to raise EUR 36 million in gross proceeds from the Rights Issue, the Rights Issue will be withdrawn. The Rights will then expire worthless, and any Rights exercise will be ignored.

- ING Bank N.V. will act as the Subscription, Listing and Paying Agent for the Rights Issue.

Indicative timetable

- The record time for allocation of the Rights is set at 17:40 CET on 12 November 2024 (the “Record Time”).

- Holders of Rights wishing to subscribe for Offer Shares must exercise their Rights during the Exercise Period, running from 9:00 CET on 11 November 2024 through 17:40 CET on 19 November 2024.

- Holders of Rights wishing to subscribe for Offer Shares under the Excess Application also, must do so during the Exercise Period, running from 9:00 CET on 11 November 2024 through 17:40 CET on 19 November 2024.

- Trading in the Rights on Euronext Amsterdam is expected to commence at 9:00 CET on 11 November 2024 and will continue until 17:34 CET on 18 November 2024, barring unforeseen circumstances.

- The Public Offering for retail investors will be open from 9:00 CET on 11 November 2024 through 17:40 CET on 19 November 2024. The Public Offering for institutional investors will be open from 9:00 CET on 11 November 2024 through 17:40 CET on 20 November 2024.

Reasons for the Rights Issue

Ebusco is currently experiencing significant financial distress and anticipates an imminent working capital shortfall. Based on its current cash position and financial requirements, the Company will not have sufficient working capital to sustain its ongoing operations. If the Rights Issue is not successfully completed, the Company will be unable to continue its current operations and will likely become insolvent.

On 25 June 2024 Ebusco withdrew its guidance for 2024 of EUR 325 million revenue and positive EBITDA due to start-up inefficiencies in the Company’s contract manufacturer model and inefficiencies at the production facility in Deurne hindering the finalization of buses and resulting in less factory output. This has not only affected the Company’s revenue, but also its ability to fully execute its cost reduction program. On 31 July 2024 Ebusco reported disappointing half year results for the period ended 30 June 2024 with revenue of EUR 38 million and a loss before tax of EUR 64.7 million. As a result, the Company has announced on 31 July 2024 that it had started developing a turnaround plan, which is aimed at improving the overall performance and delivery reliability of the Company (the “Turnaround Plan”). See for more background and a more detailed overview of the Turnaround Plan the prospectus that has been approved by the Netherlands Authority for the Financial Markets (the “AFM”), and has been published today on the Company’s website (https://investors.ebusco.com/rights-issue/) (the “Prospectus”).

The reason for the Rights Issue is to enable the Company to continue its business operations in accordance with the Turnaround Plan and improve its working capital position.

Use of proceeds

The gross proceeds from the Rights Issue are estimated to amount to approximately EUR 36 million. The Company expects the net proceeds of the Rights Issue to amount to approximately EUR 34.5 million, after deducting all expenses, including administrative and legal fees, which are estimated at EUR 1.5 million.

The net proceeds of the Rights Issue will consist of EUR 29.5 million in cash proceeds and EUR 5.0 million from the conversion of the shareholder loans provided by Peter Bijvelds Holding, ING CI and VDVI into equity. In the event the gross proceeds of the Rights Issue, including the conversion of the shareholder loans, will be lower than EUR 36.0 million, the Rights Issue will be withdrawn, the Rights will expire worthless, and any Rights exercise will be ignored.

The net proceeds of the Rights Issue will be applied to the Company’s cash needs to fund the continuation of its business operations in line with the Turnaround Plan and improving the Group’s working capital.

- Circa EUR 6.0 million to pay outstanding loans and borrowings to banks as part of the bank guarantee credit facility;

- Circa EUR 4.5 million outstanding balances to the Dutch tax authorities (related to VAT and wage tax);

- Circa EUR 7.0 million to pay overdue short-term creditors; and

- Circa EUR 12.0 million to pay the Company’s general operational costs, including upcoming employee salary payments for fixed and contingent workers, rent and housing expenses, transportation costs and consultancy expenses that are not related to the Rights Issue.

The Group further has an expected cash inflow until the end of 2024, and as a result, if Rump Shares are allocated to Gotion and resulting in lower proceeds (taking into account a minimum amount of EUR 3.4 million) applied towards general operational costs, the Group expects to have sufficient cash following completion of the Rights Issue to cover the Group’s general operational costs for the period up to the end of Q1 2025. By paying down the accounts payable position with part of the proceeds received for any Rump Shares subscribed for by Gotion, the Group can use part of the cash inflow in the month December 2024 for general operational costs, which would otherwise be applied towards paying down the accounts payable position.

As at the date of the Prospectus, the overdue accounts payable position of the Group is approximately EUR 37.0 million, of which circa EUR 7.0 million needs to be addressed immediately after the Rights Issue to resume full production and the remaining EUR 30.0 million in Q1 2025 as part of resolving the cash resources shortfall.

Additional working capital measures

As per 1 November 2024, Ebusco has a cash balance of approximately EUR 0. In its liquidity forecast for the period in between 1 November 2024 to 31 March 2025, the Company forecasts (i) a cash out of approximately EUR 90 to EUR 100 million, most significantly comprising of accounts payable, outstanding loans and borrowings, payments to the Dutch tax authorities and salaries and (ii) a cash in of approximately EUR 30 to EUR 40 million from accounts receivable collections from its bus deliveries.

As a result, Ebusco faces a working capital shortfall of approximately EUR 60 million without the Rights Issue or EUR 25.5 million after a successful Rights Issue.

To address the working capital shortfall, Ebusco has initiated an action plan. If the Company successfully resolves its cash resources shortfall in Q1 2025, the working capital position is expected to improve and turn positive during the course of Q2 2025. Following Q1 2025, Ebusco expects that the Company’s ordinary course of business will provide it with sufficient working capital. This expectation is based on the Company’s liquidity forecast for the period of Q2 2025 through Q4 2025, and largely due to the impact from the implementation of the Turnaround Plan.

To remedy this working capital shortfall, the Company has initiated the following measures (in addition to the Rights Issue):

- Expedited sale of cancelled buses: Ebusco is in active discussions with various existing customers on the sale of 61 buses under cancelled orders that are in an advanced stage of production. The Company aims to sell and deliver 48 of these buses in Q1 2025 to other customers in the Ebusco’s order book. The Company expects to generate cash flow of approximately EUR 22.7 million in Q1 2025 from the sale and delivery of such 48 buses. This positive cash flow is not included in the Group’s liquidity forecast and therefore any such generated cash flow will reduce the EUR 25.5 million cash resources shortfall envisaged for Q1 2025 accordingly.

- Improving the overdue accounts payable position: Ebusco is currently implementing a number of measures to improve its overdue accounts payable position, by paying off the amount due in instalments over time, negotiating down penalties, setting-off receivables against payables and reaching payment schedules with creditors. A significant number of creditors have indicated their willingness to accept such settlement plan. The Company will further focus on managing overdue supplier credits and manage its cash flow by delaying payments to suppliers and creditors where possible; and

- Inventory sell-down: Ebusco currently holds approximately EUR 110.0 million worth of inventory, part of which it intends to sell to third parties. This part of the inventory relates to cancelled customer orders and consists mostly of seats, heaters, cameras and mirrors, IT equipment for buses, destination signs, wheels and tires. This inventory may be sold to another customer, other bus manufacturers or to traders. Ebusco expects to generate sales proceeds of at least EUR 5.0 million by Q1 2025.

In its liquidity forecast, the Company assumes only EUR 40 million of the current EUR 50 million of the bank guarantee facilities to remain available after year-end 2024.

If the Company successfully resolves its cash resources shortfall in Q1 2025, the working capital position is expected to improve and turn positive during the course of Q2 2025. If the Company cannot successfully implement the above action plan, it will be unable to address its working capital shortfall, and may not be able to continue as a going concern and may ultimately have to file for insolvency. Please see for further details the Prospectus.

As referred to above, the Group has received an indication of interest from Gotion to subscribe for Rump Shares at the Issue Price. Any proceeds received from Rump Shares subscribed to by Gotion shall be used by the Company to pay down the accounts payable position it has with Hefei Gotion. As a result, if the Group allocates any Rump Shares to Gotion as part of the Rights Issue, the use of proceeds to pay the Group’s general operational costs referred to above will be decreased with the same amount. Payment of the accounts payable position with Gotion will be neutral from a working capital perspective.

Terms of the Rights Issue

Details of the Rights Issue are set forth in the Prospectus, which can be found on the Company’s website (https://investors.ebusco.com/rights-issue/).

Rights Issue ratio and Issue Price

3 for 1 Rights Issue of 43,853,031 Offer Shares at an Issue Price of EUR 0.8209 per Offer Share. The Issue Price represents a discount of 48.0% to the TERP, based on the closing price of EUR 3.85 on Euronext Amsterdam on 7 November 2024.

Record Time and Exercise Period

Each ordinary share held on the Record Time will entitle its holder to one (1) Right. Eligible Persons (as defined in the Prospectus) holding Rights, will be entitled to subscribe in cash, on an irreducible basis, for 3 Offer Shares for every 1 Right held from 9.00 CET on 11 November 2024 until 17:40 CET on 19 November 2024 (the “Exercise Period”).

Rights can only be exercised in multiples of the 3 for 1 subscription ratio. No fractions of Offer Shares will be issued. Except as otherwise set out in the Prospectus, once an Eligible Person has exercised his or her Rights, he or she may not revoke or modify that exercise. Any Rights that have not been validly exercised by the end of the Exercise Period will expire and can no longer be exercised.

Listing of and trading of the Rights

Trading in the Rights on Euronext Amsterdam is expected to commence at 9:00 CET on 11 November 2024 and will continue until 17:34 CET on 18 November 2024, barring unforeseen circumstances. The Rights will be listed and traded on Euronext Amsterdam under the symbol „EBUSR“ and ISIN NL0015002B01.

Option for eligible shareholders to subscribe for additional Offer Shares under the Excess Application

During the Exercise Period, holders of Rights will be entitled to subscribe, on a reducible basis, for an additional number of Offer Shares, at the Issue Price (the “Excess Application”). The subscription price of Offer Shares under the Excess Application will be equal to the Issue Price.

The Rump Shares

The Offer Shares that were issuable upon the exercise of Rights but that have not been subscribed for during the Exercise Period (the “Rump Shares”) will be offered for sale at the Issue Price through (i) a public offering in the Netherlands (the “Public Offering”) and (ii) private placements to certain institutional investors in certain other eligible jurisdictions.

The offering of Rump Shares is expected to commence no later than 09:00 CET on 11 November 2024 and to end no later than until 17:40 CET on 19 November 2024 for retail investors and 20 November 2024 for institutional investors.

The allocation of Rump Shares will be made as follows. First, the Eligible Persons who have validly submitted an Excess Application will receive a proportionate allocation of any Rump Shares, subject to the discretion of the Company. Second, the new investors who have validly subscribed for the Rump Shares will receive allocation of any remaining Rump Shares, subject to the discretion of the Company. The Company may, at its sole discretion, determine the allocation of the Rump Shares among the Eligible Persons and new investors, and may, give preference to certain new investors over Eligible Persons who have validly submitted an Excess Application.

The last date and/or time before which notification of Rights exercise and subscription for Offer Shares under the Excess Application and subscriptions for Rump Shares instructions must be given in order to be valid may be earlier, depending on the financial institution through which Rights are held.

After expiry of the Exercise Period unexercised Rights will lapse without value. Shareholders who do not wish to exercise their Rights should therefore sell the Rights during trading.

Risk Factors

The following is a summary of the key risks that, alone or in combination with other events or circumstances, could have a material adverse effect on Ebusco’s business, financial condition, results of operations or prospects, the Rights Issue, the Admission, the Offer Shares or the Rights:

- The Group is in financial distress and faces a working capital shortfall of approximately EUR 60 million without the Rights Issue or EUR 25.5 million after a successful Rights Issue. If the Group does not turnaround its business and rectify its working capital shortfall, it will become insolvent. If the Group successfully resolves its cash resources shortfall in Q1 2025, the working capital position is expected to improve and turn positive during the course of Q2 2025. In order to remedy this working capital shortfall, the Group has initiated the following key measures besides the Rights Issue: expedite the sale of buses from cancelled orders, improve the overdue accounts payable position and sell-down inventory. If the Company fails to implement one or more of these measures, it will likely face insolvency at some point in the future.

- The Group may not be able to successfully implement the Turnaround Plan or at all, and the Turnaround Plan may be insufficient to improve the operating and financial performance and reputation of the Group as planned. The Turnaround Plan has been developed to address certain root causes which have caused its financial and operational challenges. The actions proposed to do this encompass addressing an inadequate project governance structure, overcommitments on bus orders and customization requests, tied-up capital and delayed delivery of mobile energy containers. If these actions fail, the Group will likely face insolvency.

- The Group is dependent on a leadership transition for the successful implementation of the Turnaround Plan. This includes a replacement of the former co-CEO’s by a new CEO as of 30 August 2024 and a steering committee comprising the CEO, COO, CFO and the transformation director to implement the Turnaround Plan in a structured and diligent fashion. The failure to retain one or more of the persons, who are key in executing the Turnaround Plan, and any failure by the Company’s new management team in its efforts in relation to the Turnaround Plan, or otherwise failure by the Group to retain the members of this team, would jeopardize the successful implementation of the Turnaround Plan.

- Due to late delivery of buses to customers, the Group may be exposed to significant contractual penalties and direct damages claims. As at the date of the Prospectus, contractual penalties for deliveries which are already late and deliveries which are expected to be late for the 12-month period from the date of the Prospectus, on the basis of the terms of the underlying customer contracts, together with estimated potential direct damages claims are currently calculated to be, in aggregate, approximately EUR 15.7 million. To partly address the Group’s cash shortfall, the Group plans to negotiate settlements and payment schedules to alleviate part of the EUR 10 million in penalties by the end of Q1 2025. Failure to successfully negotiate these liabilities could significantly reduce the Group’s profits from its order book, adversely affecting its business, financial condition, and operational results. Additionally, future late deliveries could lead to further penalties and claims, exacerbating the financial impact.

- Due to late delivery of buses to customers, a significant number of customers may choose to cancel their orders. Late delivery of buses has already led to the termination of contracts with four customers. Order cancellations may adversely impact the Company’s financials by necessitating the search for new buyers, re-customization of buses, increased inventory, reduced cash flow, and reputational damage. Further cancellations could trigger a ’snowball‘ effect with other customers cancelling their orders in response to the other cancellations. Any such cancellations may also be accompanied by direct damages claims.

- Due to the Company’s current financial situation, the Group depends on third-party suppliers agreeing to payment schedules and alternative settlement options on overdue accounts. As at the date of the Prospectus, the Group’s overdue accounts payable position is approximately EUR 37 million. If suppliers refuse to agree on settlement terms, the Group’s Turnaround Plan could fail due to insufficient cash resources, potentially leading to a full shutdown of production and a significant negative impact on revenue and operations. Continued significant accounts payable could result in suppliers withholding essential supplies or taking legal action, further straining cash resources and risking enforcement actions that could harm or halt operations. Under Dutch law, multiple creditors with overdue accounts could initiate bankruptcy proceedings against the Group, necessitating insolvency filing if the Group cannot settle these accounts. Although some suppliers have issued legal notices for payment, these are currently manageable within the Group’s cash flow.

- Due to the Group’s current financial situation, the Group has breached its bank guarantee facilities. On 18 September 2024, the Group received a reservation of rights letter from its lenders alleging breaches of obligations under the bank guarantee facilities, including unpaid amounts totaling c. EUR 6.2 million, which could lead to the acceleration and cancellation of these facilities. The lenders have taken a constructive approach by allowing the Group time to secure additional shareholder funding while demanding various security rights, but they still retain the right to accelerate the debt and cancel the facilities at any time. If the guarantee facilities are terminated, the Group’s business model, which relies on letters of credit for contract manufacturers, would be jeopardized, potentially leading to halted operations and insolvency.

The main risks relating to the Rights Issue and the Ordinary Shares include:

- The market price of the ordinary shares will fluctuate, and may decline below the Issue Price;

- The Group cannot assure investors that an active trading market will develop for the Rights and, if a market does develop, the market price of the Rights will be affected by, and may be subject to greater volatility than, the market price of the ordinary shares;

- Shareholders will experience significant dilution as a result of the Rights Issue if they do not or cannot exercise their Rights in full; and

- If Eligible Persons do not properly and timely exercise their Rights, they may not be able to subscribe for Offer Shares at the Issue Price and, if Shareholders do not properly and timely sell their Rights, they may not receive any compensation for their unexercised Rights.

Strategic Partnership with Gotion

On 8 November 2024 the Group announced a proposed strategic partnership with Gotion, which envisages (i) mobilizing Gotion’s advanced battery technology, allowing the further development of Ebusco’s lightweight buses with a substantial longer range battery, (ii) supporting the Group in international expansion of the lightweight buses in Asia, in line with the Group’s strategy to license out its Ebusco 3.0 lightweight technology outside the European market, and (iii) cooperating in relation to the expansion of Ebusco’s maritime offering.

With Gotion as a strategic partner and future shareholder, the Group aims to strengthen its position as an innovative frontrunner in the rapidly expanding market of electric buses and associated ecosystems.

The settlement arrangements with CVI

In order to facilitate the Rights Issue, CVI has agreed to adjust the lower prevailing minimum price under the convertible bonds terms from EUR 5.00 to EUR 0.25 (below which CVI is entitled to require instalment payments are paid in cash) and to accept a reset of the conversion price to 110% of the TERP of the Rights Issue under this arrangement rather than to the Issue Price. Further, CVI has agreed to (i) the equitization of the instalment payments for December 2024 and March 2025, to be converted into 7.0 million new ordinary shares, which are to be issued at the Settlement Date regardless of the Issue Price (i.e. as a fixed amount of shares); (ii) the deferral of the instalment payments for June 2025, September 2025 and December 2025 to the final maturity date (21 December 2026); and (iii) the deferral of interest payments owing by the Company for December 2024 and March 2025 to June 2026.

Dilution

Shareholders who transfer, or who do not or are not permitted to exercise any of their Rights granted under the Rights Issue will suffer a dilution of their proportionate ownership and voting rights of approximately 75% as a result of the issue of the Offer Shares (or 78% taking into account the 7.0 million new ordinary shares to be issued to CVI under the settlement arrangements with CVI, and a further 14% if CVI further elects to convert all of its outstanding bonds immediately after the Settlement Date).

Indicative timetable

Subject to acceleration or extension of the timetable for, or withdrawal of, the Rights Issue, the timetable below sets forth certain expected key dates for the Rights Issue. All times are in Central European Time.

| Event | Time and Date |

| Launch of the Rights Issue and publication of the Prospectus | 8 November 2024 |

| Start of ex-Rights trading in the ordinary shares on Euronext Amsterdam | 9:00 hours on 11 November 2024 |

| Ex-rights date and start of trading in the Rights on Euronext Amsterdam | 9:00 hours on 11 November 2024 |

| Start of the Offering Period | 9:00 hours on 11 November 2024 |

| Start of the Exercise Period | 9:00 hours on 11 November 2024 |

| Record Time | 17:40 hours on 12 November 2024 |

| End of trading in the Rights on Euronext Amsterdam | 17:34 hours on 18 November 2024 |

| End of the Exercise Period | 17:40 hours on 19 November 2024 |

| End of the Offering Period for retail investors | 17:40 hours on 19 November 2024 |

| End of the Offering Period for institutional investors | 17:40 hours on 20 November 2024 |

| Allotment and issue of the Offer Shares | 21 November 2024 |

| Settlement Date | 25 November 2024 |

| Listing of and start of trading in the Offer Shares on Euronext Amsterdam | 09:00 hours on 25 November 2024 |

Availability of the Prospectus

The Rights Issue is being made only by means of the Prospectus, approved by, and filed with, the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) (the “AFM”) on 8 November 2024 as competent authority under the Prospectus Regulation. The Prospectus is available electronically, free of charge, via the website of the Company (https://investors.ebusco.com/rights-issue/), subject to securities law restrictions in certain jurisdictions.

Order book and other updates

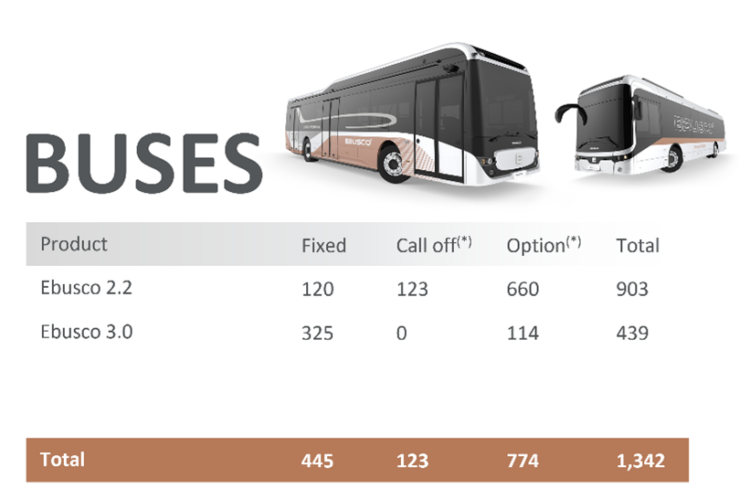

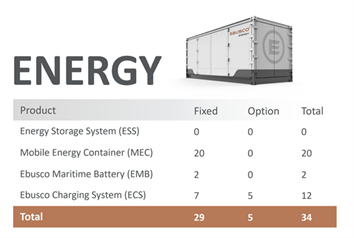

The Company’s actual order book at the date of this press release is as follows:

* There is no guarantee that these call-off orders and options will be converted into fixed orders as clients may not be successful in winning tenders or for other reasons

On 24 October 2024 the Company announced that the Chief Technology Officer (CTO) will leave the company by the end of the year. The CTO’s tasks will be combined with that of the Chief Operating Officer, to achieve a leaner organization and reduced management team size.

Previous announcements

On 21 October 2024, the Company announced that Qbuzz, a customer of Ebusco, had cancelled an order for 59 buses, including 45 12‑meter buses and 14 18‑meter buses, for alleged late delivery and that Qbuzz levied pre-judgment attachment on some of the Company’s bank accounts on 17 October 2024. The Company instituted legal proceedings to seek delivery to, and payment from, Qbuzz for the order for 45 12-meter buses, which were at that date already produced. To preserve its working capital, the Company announced that it largely suspended its production in anticipation of the outcome of the legal proceedings and the completion of the Rights Issue. The Company also announced that it received a cancellation letter from Connect Bus and Keolis, two other customers of the Group, for 47 Ebusco 3.0 buses and 50 Ebusco 3.0 buses, respectively. The Company announced that it reached an agreement of dissolution with both customers. As part of the order from Connect Bus was already in an advanced stage of production, the Company also announced that it had entered in discussions with various parties to sell these already produces buses. With respect to Keolis, the option for a minimum of 75 Ebusco 3.0 buses was reinforced between the parties.

On 24 October 2024, in anticipation of the Extraordinary General Meeting of the Company scheduled for later that day, the Company published a trading update for Q3 2024 and further details on the Turnaround Plan. With regard to its financial position, the Company announced that, due to its financial situation and overdue accounts payable position, its production of new buses had come to an almost standstill, leading to late deliveries and a severe cash shortfall, with the lowest point in working capital in Q1 2025. The Company announced certain measures to bridge that working capital gap, assuming completion of the Rights Issue in November 2024. In addition, the Company announced (i) a breach of payment on its guarantee facilities in the amount of approximately EUR 6.2 million and the related security rights granted to the lending parties, (ii) the outcome of the legal proceedings against Qbuzz, (iii) the latest management changes, including that the CFO will leave the Company after completion of the Rights Issue, (iv) further detail on its customer order book and (v) that it is in negotiations regarding a strategic partnership with one of its suppliers and a licensing of its Ebusco 3.0 lightweight technology.

In a separate press release on 24 October 2024, the Company announced that the pre-judgment attachment on some of its bank accounts, as announced on 21 October 2024, had been lifted and that Ebusco has access to its bank accounts again.

Following the EGM, the Company announced the adoption of the resolution to (i) appoint Mr. Schreyer as the Group’s CEO for a term ending at the end of the AGM to be held in 2028, (ii) deviate from the remuneration policy in respect of Mr. Schreyer and grant 300,000 Ordinary Shares (pre the Share Consolidation) that will vest in three years provided that Mr. Schreyer is still working for the Company in the role of CEO at that time, (iii) amend the Articles of Association and implement the Share Consolidation, and (iv) issue up to EUR 36 million in shares and exclude pre-emptive rights in respect thereof.

On 4 November 2024, the Company announced that it received indications of interest from a group of investors, including larger existing shareholders, to support the Rights Issue through a combination of pre-commitments and underwriting. The Company also announced that it is negotiating a partnership with one of its strategic suppliers which would provide for an equity injection. Further, the Company announced that it had negotiated another customer settlement under which the Company is released from the obligation to deliver 76 Ebusco 3.0 buses that the Company was unable to produce on time. The related contractual penalty amounts have also been substantially reduced and will be payable in tranches over time, relieving the short-term pressure on the Company’s cash position. Some of the cancelled buses were already in an advanced stage of production. Therefore, the Company will proceed in selling those buses to other customers.

On 8 November 2024, the Company announced a proposed strategic partnership with Gotion. See “Strategic Partnership with Gotion” above.

The press releases can be found on the Company’s website at: https://www.ebusco.com/category/press-release/.

Information for Retail Investors

The Company has made available on its website a Frequently Asked Questions document and a document explaining the mechanics of the Rights Issue, both in the Dutch language. See the website of the Company (https://investors.ebusco.com/rights-issue/).

Prospective investors should carefully read and review the entire Prospectus and should form their own views before making an investment decision with respect to the Rights and the Offer Shares. Furthermore, before making an investment decision with respect to the Rights and the Offer Shares, prospective investors should consult their own professional adviser and carefully review the risks associated with an investment in the Rights and the Offer Shares and consider such an investment decision in light of their personal circumstances.

This press release contains information that qualifies, or may qualify, as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation. This press release was distributed at 08:00 on 8 November 2024.

Disclaimer

These materials are not for release, distribution or publication, whether directly or indirectly and whether in whole or in part, in or into the United States, Australia or Japan or any other jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction.

These materials are for information purposes only and are not intended to constitute, and should not be construed as, an offer to sell or a solicitation of any offer to buy the securities of Ebusco Holding N.V. (the Company, and such securities, the Securities) in the United States, Australia or Japan or in any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of such jurisdiction.

This announcement is not for publication or distribution, directly or indirectly, in or into the United States. This announcement is not an offer of securities for sale into the United States. The Securities have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States. No public offering of securities is being made in the United States.

The Company has not authorised any offer to the public of Securities in any Member State of the European Economic Area and the United Kingdom other than the Netherlands, Belgium and France. With respect to any Member State of the European Economic Area and the United Kingdom, other than the Netherlands, Belgium and France (each a Relevant Member State), no action has been undertaken or will be undertaken to make an offer to the public of Securities requiring publication of a prospectus in any Relevant Member State. As a result, the Securities may only be offered in Relevant Member States (i) to any legal entity which is a qualified investor as defined in section 2(e) of the Prospectus Regulation; or (ii) in any other circumstances falling within section 1(4) of the Prospectus Regulation. For the purpose of this paragraph, the expression „offer of securities to the public“ means the communication in any form and by any means of sufficient information on the terms of the offer and the Securities to be offered so as to enable the investor to decide to purchase or subscribe for the Securities and the expression „Prospectus Regulation“ means Regulation (EU) 2017/1129 and includes any relevant delegated regulations.

No action has been taken by the Company that would permit an offer of Securities or the possession or distribution of these materials or any other offering or publicity material relating to such Securities in any jurisdiction where action for that purpose is required.

The release, publication or distribution of these materials in certain jurisdictions may be restricted by law and therefore persons in such jurisdictions into which they are released, published or distributed, should inform themselves about, and observe, such restrictions.

These materials may include statements, including the Company’s financial and operational medium-term objectives that are, or may be deemed to be, “forward-looking statements“. These forward-looking statements may be identified by the use of forward-looking terminology, including the terms “believes“, “estimates“, “plans“, “projects“, “anticipates“, “expects“, “intends“, “may“, “will“ or “should“ or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals, future events or intentions. Forward-looking statements may and often do differ materially from actual results. Any forward-looking statements reflect the Company’s current view with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to the Company’s business, results of operations, financial position, liquidity, prospects, growth or strategies. Forward-looking statements speak only as of the date they are made. Each of the Company and any its affiliates expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statement contained in these materials whether as a result of new information, future developments or otherwise, except to the extent required by applicable law.

This announcement does not constitute a prospectus. An offer to acquire Securities pursuant to the proposed offering will be made, and any investor should make his investment, solely on the basis of information that will be contained in the prospectus to be made generally available in the Netherlands in connection with such offering. When made generally available, copies of the prospectus may be obtained at no cost from the Company or through the website of the Company.

Information to distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended (MiFID II); (b) sections 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the MiFID II Product Governance Requirements), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any „manufacturer“ (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the Securities subject to the Offering have been subject to a product approval process, which has determined that such Securities are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the Target Market Assessment).

Notwithstanding the Target Market Assessment, „distributors“ (for the purposes of the MiFID II Product Governance Requirements) should note that: the price of the Securities may decline and investors could lose all or part of their investment; the Securities offer no guaranteed income and no capital protection; and an investment in the Securities is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Offering.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the Securities.

Each distributor is responsible for undertaking its own target market assessment in respect of the Securities and determining appropriate distribution channels.

Deutsch

Deutsch  Nederlands

Nederlands  Français

Français  English

English  English (Australia)

English (Australia)