Deurne, 16 December 2025 – Ebusco Holding N.V. (Euronext: EBUS) provides a brief business update ahead of its Annual General Meeting that is scheduled for later today.

Results in Q3 2025 reflect the impact of the transition to the OED model and the ongoing restructuring efforts, however, the liquidity constraints persist

In light of today’s annual general meeting of shareholders, Ebusco herewith provides a brief update of its financial performance in Q3 2025 and its financial condition as per 30 September 2025.

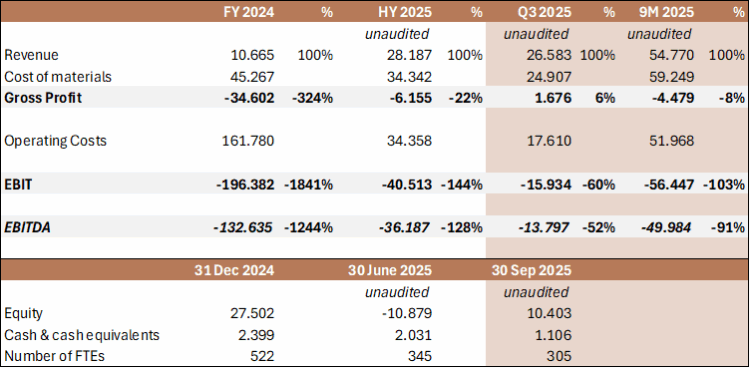

This section includes some selected key financials for Q3 2025 and the nine-month period ended 30 September 2025 (9M 2025), compared to FY 2024 and the first half year of 2025 (HY 2025).

Selected key financials for the periods indicated (all in EUR 1,000 unless otherwise indicated)[1]

[1] These selected financials include measures (such as Gross Profit, EBITDA and EBIT) which are not defined by IFRS. Ebusco believes this information, along with comparable IFRS-measures, is useful to the management board, investors and other stakeholders because it provides a basis for measuring the company’s operating performance.

Performing on its bus delivery schedule has been and remains a key priority for Ebusco (see also under “Stable pace of deliveries continues” below). The enhanced reliability in the bus delivery program has led to recognition of revenue over the course of 2025 year-to-date as indicated in the table above.

Ebusco further wishes to highlight the positive impact of the transition from the Original Equipment Manufacturer (OEM) to the Original Equipment Design (OED) model on its Gross Profit in Q3 2025, with a positive gross profit margin of 6% (vs. -22% over HY 2025).

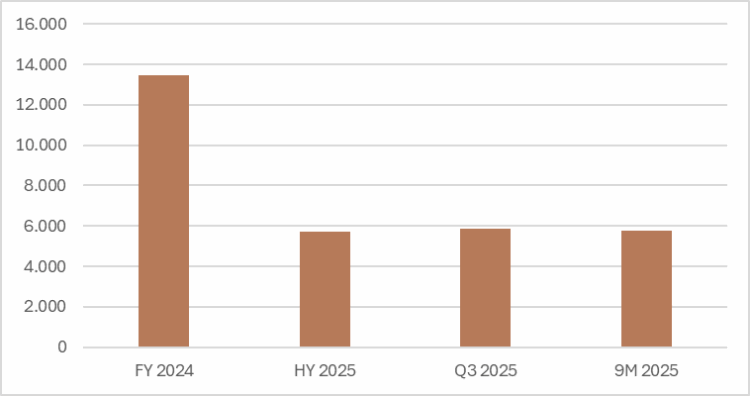

Under the OED model, which follows from the comprehensive Turnaround Plan that the company initiated in 2024, the casco and bus assembly is handled by Ebusco’s contract manufacturers. This transition away from in-house production under the OEM model is largely completed and has also positively impacted Ebusco’s operating costs as illustrated in the graph below:

Average Operating Costs per month for the periods indicated (all in EUR 1,000)[2]

[2] Operating Costs in Q3 on a ‘per month’ basis are slightly higher than in HY 2025 due to, amongst others, one-off effects related to the July 2025 restructuring of the loans and the advisory expenses related to the ongoing strengthening of the Finance organization and processes

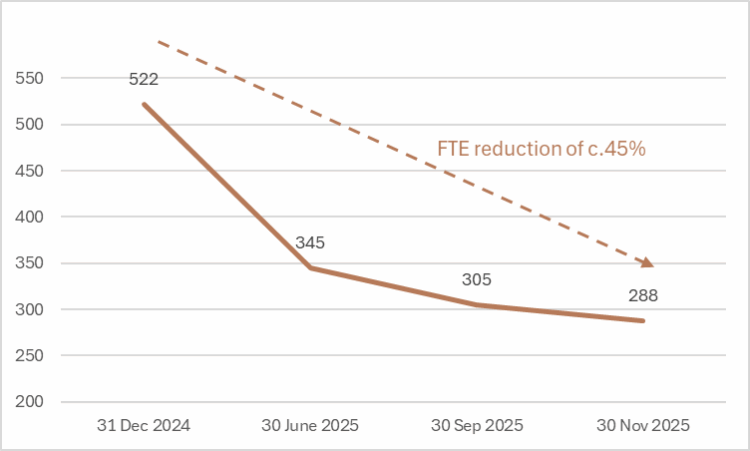

The reduction in Operating Costs is also the result of the consolidation of the Dutch operations into a single, more efficient facility in Deurne and the comprehensive FTE reduction program that Ebusco initiated at the end of FY 2024, leading to an FTE reduction over time of circa 45% as illustrated in the graph below.

Number of Full Time Equivalents (FTEs) for the periods indicated

Ebusco’s equity position as at 30 September 2025 was again positive, at EUR 10.4 million (versus EUR -10.9 million as at 30 June 2025), which is largely the result of the comprehensive restructuring plan that Ebusco announced on 7 July 2025, which included a debt-for-equity swap of outstanding loans.

Ebusco’s cash & cash equivalents position as at 30 September 2025, however, was only c. EUR 1.1 million, illustrating the persistent cash constraints that Ebusco deals with (see also section “Update on remedial actions to address the persistent cash constraints” below).

Stable pace of bus deliveries continues

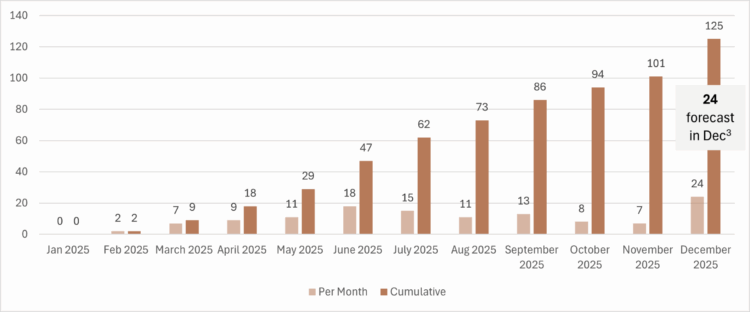

On 15 August 2025 Ebusco reported that it delivered 47 buses to its clients in the first half of the year (the vast majority of which in Q2 2025) and 39 buses in Q3 2025. Over Q4 2025 Ebusco expects to deliver 39 buses, in line with the number of buses it delivered in Q3[3].

The chart below illustrates the bus deliveries over the year, per month and on a cumulative basis. For the full year 2025 the expected number of bus deliveries is 125 (versus 157 in 2024).

[3] For some of the remaining deliveries in the final weeks of this year, Ebusco is to an extent depending on the availability of its clients for the Factory Acceptance Test of the buses

Bus deliveries over 2025 (in number of buses)

Current order book and focus on winning new orders

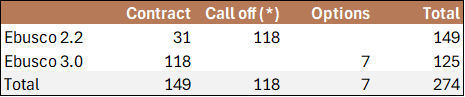

The order book per 30 November 2025 is as follows:

(*) There is no guarantee that these call-off orders will be converted into fixed orders as customers may not be successful in winning tenders or for other reasons. However, if the customer orders an electric bus, it is contractually obliged to ask Ebusco to deliver it first.

Ebusco expects to deliver the last orders of the existing order book before the end of Q3 in 2026. Ebusco’s management is now increasingly focused on adding new business to the existing order book.

A recent market study by Rabobank[4] highlighted that Europe’s city bus market is undergoing a rapid transition toward zero-emission fleets; registrations of battery-electric city buses (BECBs) in Europe are increasing steadily, widening the gap with diesel city buses. By the end of this year, Rabobank expects BECBs to account for up to 75% of all new registrations putting the EU’s 2030 target of 90% zero-emission sales within reach. According to Rabobank, this shift is driven by regulatory pressure, technological improvements, and strategic financing mechanisms. This confirms management’s view that the market fundamentals remain strong and that the market for zero emission buses continues to be a ‘sellers’ market, as all bus operators continue to have high demand for electric buses.

Ebusco is in advanced discussions with a party that specializes in service and financing constructions for Public Transport Authorities (PTAs) and Public Transport Operators (PTOs) to accelerate the electrification of both new and existing fleets. This may lead to reassigning the remaining buses that were previously cancelled and to incorporating existing fleets into a long-term transport as a service solution. Through this approach, Ebusco’s Service & Maintenance performance will also be strengthened, positioning this function as a key element of Ebusco’s business model to support its clients.

Furthermore, Ebusco expects an existing German customer to participate in an upcoming tender involving approximately 70 Ebusco buses, subject to the completion of the customer’s tender process in the coming period.

[4] Rabobank market study: “How finance and tender design drive Europe’s city bus transition”, 19 November 2025

Update on remedial actions to address the persistent cash constraints

On 3 December 2025 Ebusco announced that it secured a working capital bridge loan of EUR 5.1 million, also in the context of some delay in the implementation of some of the remedial actions. The proceeds of the loan allowed Ebusco to safeguard the ongoing delivery of its buses on time (and avoid any contractual penalties for late delivery), which will result in a corresponding conversion of working capital into cash over time, and assists in the ongoing stabilization of Ebusco.

The status of the remedial actions is as follows:

- Further progress has now been made on the remaining c. EUR 4.0 million working capital support, with an additional tranche of approximately EUR 1.0 million expected in the near term;

- In line with what Ebusco reported previously, the framework agreement with a Chinese contract manufacturer has been signed and production activities have commenced. However, the local financing structure for the procurement of required materials has not yet been secured and remains subject to further arrangements and approvals. As a result, Ebusco is currently funding the related pre-payments and payments from its own cash flow. Any further optimization of this local financing structure is expected towards the end of Q1 2026 or early Q2 2026; and

- On 7 July 2025 Ebusco announced that it has signed a large energy contract with a European client. The agreement covers a minimum of 600 MWh of various Energy Storage Systems (ESS) and ESS related equipment, with a total contract value of approximately EUR 39 million. The first tranches under the contract are now due, expecting to generate cash before the end of 2025, which assists in addressing the working capital constraints.

Accordingly, Ebusco’s continuity as a ‘going concern’ remains dependent on effective cash flow management, the continued implementation of the remedial actions and support, and ongoing cooperation with creditors and suppliers, including negotiated and phased management of claims and overdue accounts payable. Despite all progress, efforts and the underlying sound market fundamentals, Ebusco’s liquidity constraints continue to persist and it continues to face various operational and financial challenges, which result in a material uncertainty regarding Ebusco’s ability to continue as a going concern.

Update on organizational matters

Ebusco is still in the process of selecting a new CEO. Discussions have been held with a high-profile, experienced candidate but have not reached a conclusion, due to the fact that the candidate’s demands were not in line with the company’s remuneration policy. As a result, the search for a new CEO continues.

In any event, subject to the approval in today’s AGM, Ebusco welcomes the appointment of Roel Nagelmaeker as the permanent CFO and Ms. Mariëtte Doornekamp, Mr. Olaf de Bruijn and Mr. Rob Engelschman as new members of the Supervisory Board (in Mr. Rob Engelschman’s case per 1 April 2026).

Ebusco’s governance is further strengthened by the appointment of Mr. Hou Fei as member elect of the Management Board, bringing experience in production and Electrical Vehicle (EV) technology across both OEM and OED models, with formal appointment to follow at a forthcoming Extraordinary General Meeting.

Furthermore, Ebusco is committed to continue to strengthen its organization and processes, partly as a result of the recent switch from an OEM to an OED, which requires a redesign of Ebusco’s internal control framework. More specifically, Ebusco is making good progress in taking fundamental measures to improve the quality of its financial reporting, operational control and audit readiness. These measures include, but are not limited to:

- Recent strengthening of the Finance organization with a number of new hires (with specific audit, reporting and internal control experience);

- Re-establishment of the internal control framework starting with key and basic controls, followed by a complete and thorough internal control framework fitted to the new OED business model;

- Improving the automation processes and controls; and

- Reinstallation of the internal audit function in the coming period.

Update on the outstanding Convertible Bond

Today circa EUR 12.3 million is remaining of the initial EUR 36.8 million convertible bond with Heights Capital Management (Heights). A new quarterly instalment is due prior to the end of 2025 and expected to convert in new Ebusco shares similar to the recent instalments. These new shares will then be issued to Heights in the week commencing 22 December 2025. The current number of Ebusco shares outstanding is 194,269,627. Following the December 2025 instalment three quarterly instalments remain (in March, June and September 2026).

Calendar for the remainder of the year

| Annual General Meeting | Today, 16 December 2025 |

Français

Français  Nederlands

Nederlands  Deutsch

Deutsch  English

English  English (Australia)

English (Australia)